IAS 11 defines construction contract as:

“… a contract specifically negotiated for the construction of an asset or a combination of assets …”

Examples of construction contracts include those negotiated for the construction of highways, buildings, oil rigs, industrial units, pipelines, airlines and other similar assets. IAS 11 deals with accounting of construction contracts from the perspective of the contractors who undertake such projects on behalf of its clients. Self constructed assets for an entity’s own use are accounted for in accordance with IAS 16 and are not within the scope of IAS 11 Construction Contracts.

Accounting Problem

Whereas in most industries, business process cycles are completed within a relatively short period of time, it is normal practice in the construction industry for the duration of projects to extend beyond one year. Before the introduction of IAS 11 Construction Contracts, revenue was recognized by construction firms on Completed Contracts Basis under which, profit on the construction contract was deferred until the completion of the related project. As a result, there was a considerable time lag between the performance of contract obligations and the recognition of related profit.

Completed Contract basis of accounting for construction contracts was considered by many as being too prudent in that no revenue was recognized in respect partially completed construction projects even when inflow of economic benefits could be reasonably expected. Also, this method of accounting contradicted with the fundamental accruals concept of accounting whereby income and expenses are recognized in the accounting period in which they are incurred.

IAS 11 Construction Contracts - Accounting Treatment

IAS 11 Construction Contracts was introduced in order to counter the deficiencies observed in accounting for construction contracts. It defines how a contractor should recognize costs and revenue over the life of a construction contract.

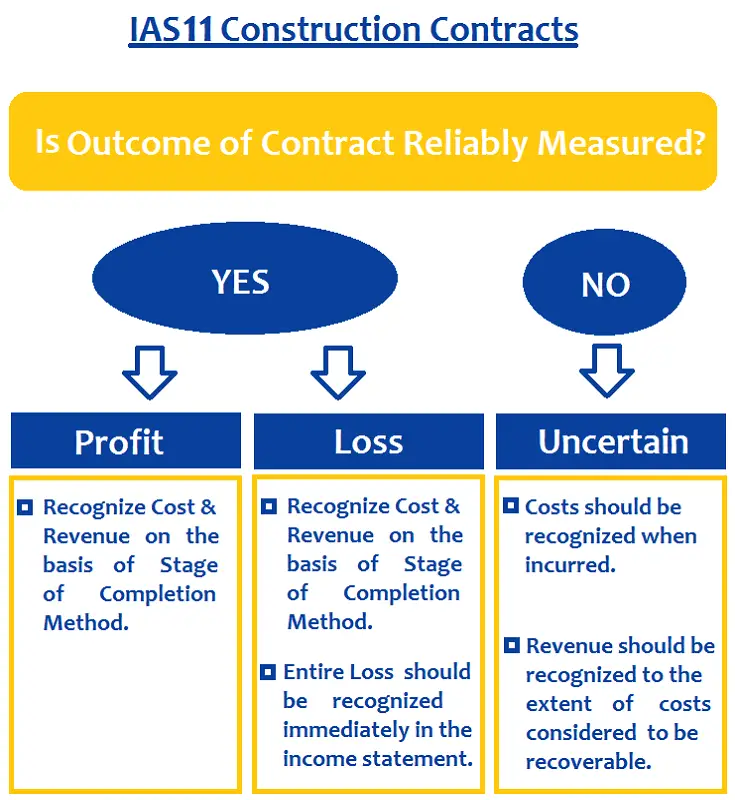

IAS 11 proposes accounting for construction contracts on the basis of expected outcome.

a) Outcome of a contract can be reliably measured:

- Net Profit: If a profit is expected under the contract, revenue and costs (and hence profit) are to be recognized in the income statement based on the Stage of Completion of the contract (also known as Percentage of Completion Basis).

- Net Loss: If a net loss is expected under the contract, the entire loss is recognized immediately in the income statement. Revenue and contract costs are recognized in the income statement on the basis of Stage of Completion of the contract.

b) Outcome of contract cannot be measured reliably:

- Uncertain: If the outcome of construction contract is uncertain, no profit is recognized. Costs are recognized in the period in which they are incurred. Revenue is only recognized to the extent of costs incurred that are expected to be recovered.

Objective

The proposed treatment of a construction contract by IAS 11 balances the requirement to present financial statements under Accruals Basis, and the conventional wisdom of the Prudence Concept. Where a net inflow of economic benefits under a construction contract is probable, costs and revenue are recognized to the extent of completion of the contract (i.e. Accruals Basis). If however a loss is expected under the contract, the entire loss is immediately recognized (i.e. Prudence Concept).

Summary

The following diagram summarizes the accounting treatment of construction contracts under IAS 11.